Blog

VA Home Loans: The Most Underutilized Home Path For Heroes

Posted by: Dennis Greco

Date: May 05, 2020

Posted by: Dennis Greco

Date: May 05, 2020

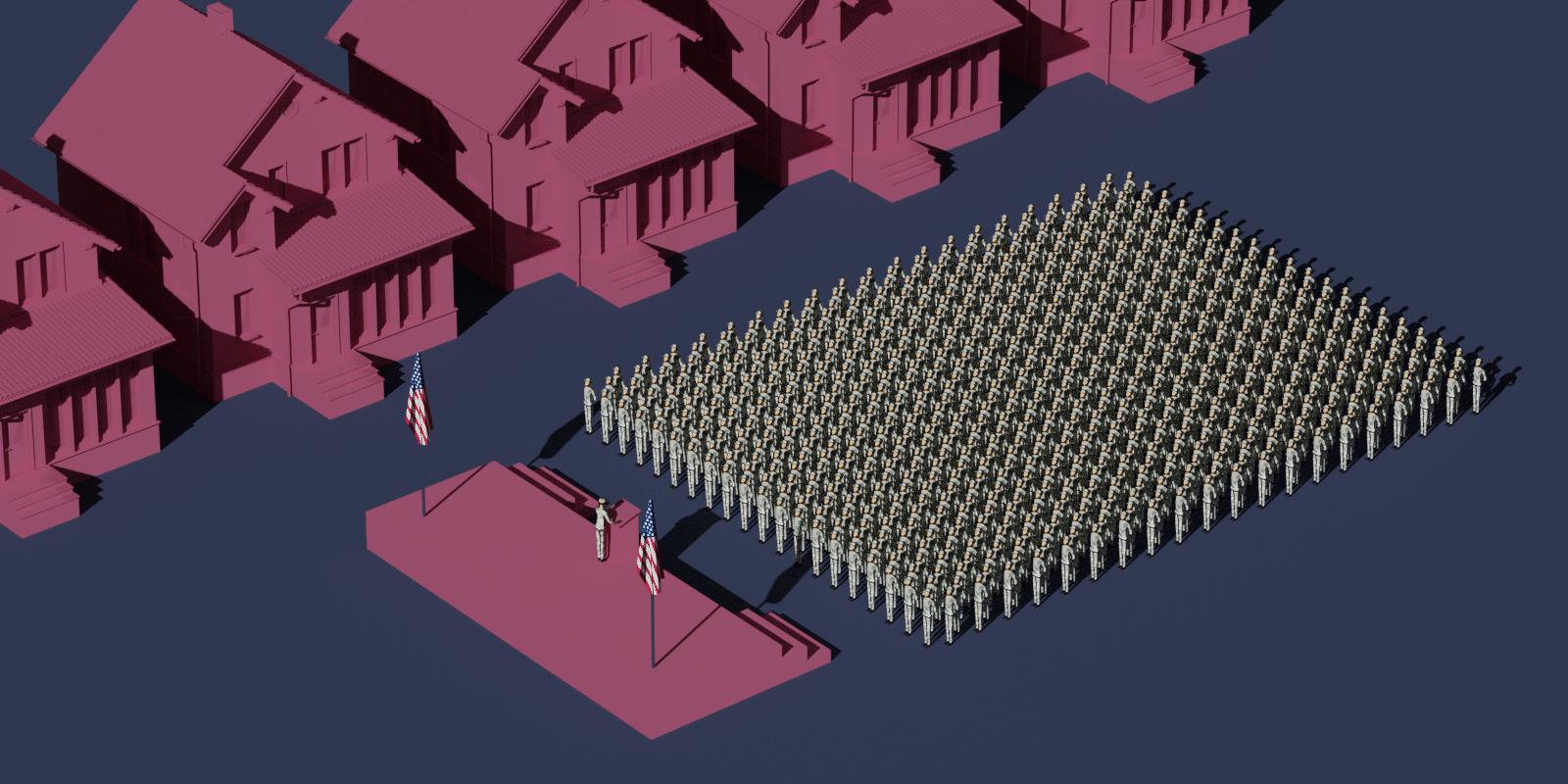

For many people, purchasing a home will be the single largest investment they will make in their lifetime which can be financially intimidating. This can create a sense of doubt that unnecessarily delays even the savviest savers from reaching their goals. The good news is, if you’ve served in the Armed Forces, the American dream is a lot easier to achieve than most people know.

Since 1944, the Department of Veterans Affairs (VA) has offered an incredible home loan benefit to Service members, Veterans, and eligible spouses, but shockingly it’s one the most underutilized financing options in the today’s real estate market. According to government data, fewer than 12% of the country’s estimated 24 million veterans currently use these benefits, despite the numerous advantages. VA loans are federally insured, offer 100% financing, have no maximum loan limit, and can be used over and over again throughout your lifetime. These loans can even be structured to reduce out-of-pocket expenses for buyers while providing a better return for sellers.

To apply for a VA loan, first you need to make sure that you are eligible. Below are the minimum service requirements needed to qualify for the program:

Second, you will have to apply for a Certificate of Eligibility (COE). This can be done through the VA/DOD eBenefits online portal or through your lender. Different forms are required depending on your status, so I recommend speaking with a lender first. A good lender will guide you through the application steps and outline exactly what is required. While working with the lender they will also request documentation to assess if you’re a good risk for a mortgage. One perk of a VA loan is it weighs residual income more heavily than your debt-to-income ratio. Simply put, the lender must ensure the borrower makes enough money to pay the mortgage. Another attractive benefit is there is no minimum credit score requirement. Most lenders will want you to have at least a 580 FICO score, but don’t let that deter you from applying. Borrowers have been approved with less, and a good lender should be able to make recommendations that will bump up your score quickly.

The VA loan differs from other traditional loans because you can finance 100% of the purchase price. With other loans, any time less than 20% of the home’s purchase price is used as a down payment the financial institution requires Private Mortgage Insurance (PMI), which is a monthly fee charged by your lender to ensure the home will not go into default. This can be expensive over time and difficult to remove. When you obtain a VA loan you avoid PMI fees, but there is a VA funding fee (Veterans in receipt of disability compensation are exempt from paying the funding fee). The funding fee can be financed or paid all or part in cash, and is far less expensive than PMI over the life of the loan. The basic funding fee is 2.3% for first time use and 3.6% for repeat use, but you can use a down payment to lower the fee if you would like (see below).

Ultimately, this is another win for borrower. Without mortgage insurance the buyer can qualify for a larger loan or have an overall lower payment compared to non-VA borrowers.

VA loans do not require a down payment. If money is available to put down, a veteran may do so, as this will reduce the amount, he/she is borrowing. However, the purpose of the VA loan program is to ensure every veteran has the opportunity to own a home. As such, there is no down payment requirement for a VA loan.

The appraisal is a key component in the home buying process and a requirement for all lending institutions. The purpose of a VA appraisal is two-fold. First, to determine the home’s fair market value and secondly, to determine if the home meets the VA’s minimum property requirements (MPRs). The MPR guidelines are simple – ensure the property is safe, sound, and sanitary. Appraisers are not inspectors, but they will observe and document problems with the roof, structure, sewer or septic, and water supply that can impact the loan approval. In the rare event a property does not appraise for the purchase price you can take the following steps:

Request a reconsideration of value – your real estate agent can provide a list of comparable properties to the lender to show the home is worth more than its appraised value. These can be presented to the appraiser for reconsideration.

The goal of Veteran’s Affairs is to help applicants buy, build, and/or repair a home for personal occupancy, so they’ve created a financing option that is both obtainable and rewarding for our country’s Heroes. The opportunity for 100% financing with no minimum credit requirements, combined with historically low interest rates and motivated sellers, makes this the perfect time to capitalize on all of the benefits that this underutilized loan program has to offer.

Written by Dennis Greco – Dennis is a real estate agent at CENTURY 21 Northwest Realty.

© 2020 Centurion Investments, Inc. All rights reserved.

CENTURY 21® and the CENTURY 21 Logo are registered service marks owned by Century 21 Real Estate LLC. Centurion Investments, Inc. fully supports the principles of the Fair Housing Act and the Equal Opportunity Act. Each office is independently owned and operated. Any services or products provided by independently owned and operated franchisees are not provided by, affiliated with or related to Century 21 Real Estate LLC nor any of its affiliated companies.